where's my unemployment tax refund irs

We will contact you by mail when we need more information to process your return. The American Rescue Plan Act allows eligible taxpayers to exclude up to 10200 up to 10200 for each spouse if married filing jointly from their gross income which will likely lower the tax liability.

Irs Unemployment Tax Refund Timeline For September Checks

Updated March 23 2022 A1.

. To check your return online use the Wheres My Refund service or the IRS2Go mobile app. See How Long It Could Take Your 2021 State Tax Refund. This made it so the IRS needed to issue refunds specifically for unemployment wages.

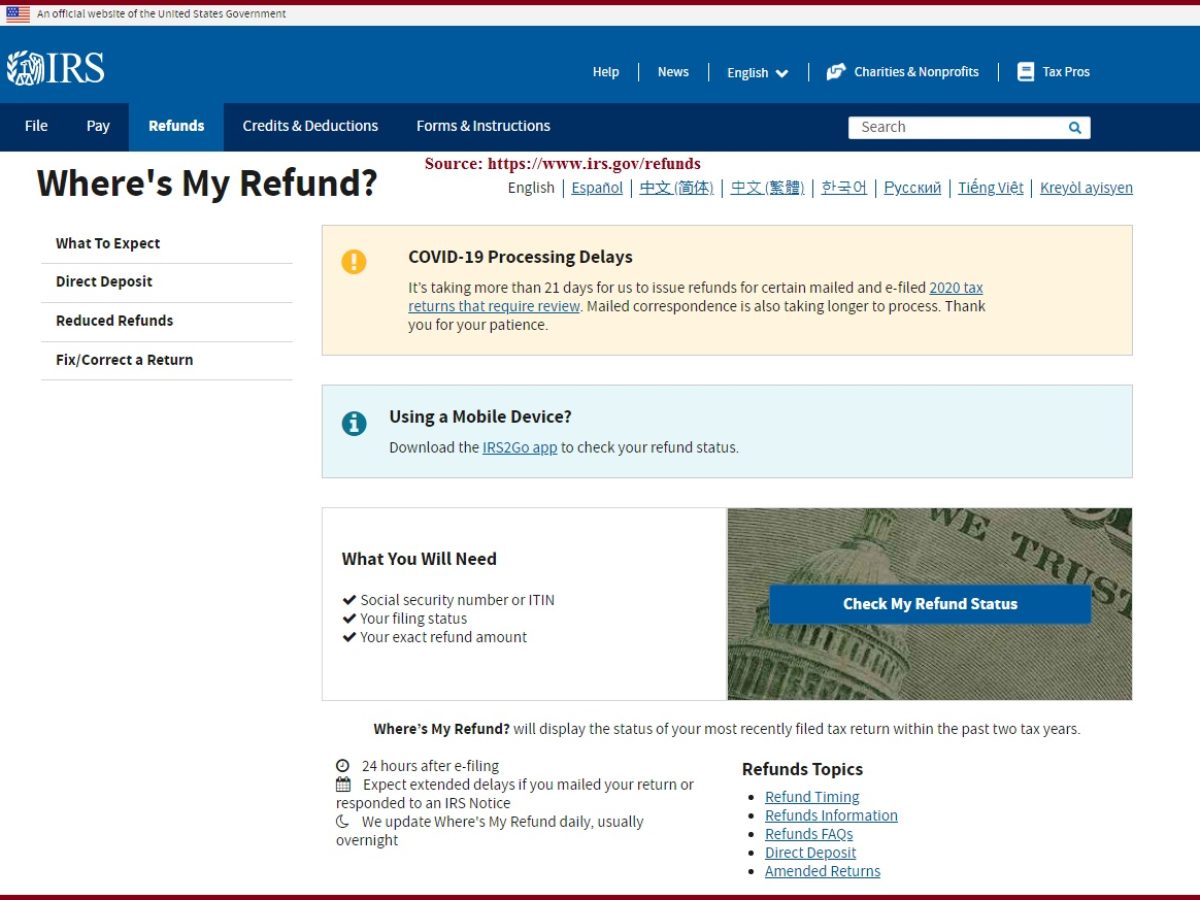

I was on unemployment and paid in taxes. Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund. You can try the IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool but they may not provide information on the status of your unemployment tax refund.

Got my refund March 15th. I amended my taxes May 12th for the stimulus rebate for my son and received the 1100 due 2 weeks ago and on the notice CP21B it said for unemployment rebate also. Check your unemployment refund status by entering the following information to verify your identity.

Many Americans had already filed their taxes and paid on the unemployment benefits they received in 2020 before the new law was passed. Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund. Every 24 hours the systems are upgraded.

For eligible taxpayers this could result in a refund a reduced balance due or no change to tax. Because older tax refunds which include form 8379 it could take up to 14 weeks to process. 12 the IRS shared that they have issued over 118 million refunds but.

Unemployment tax refunds started to land in bank accounts in May and have continued throughout summer as the IRS processes the returns. 22 2022 Published 742 am. Usually the Internal Revenue Service issues all the tax refunds within 21 days of the tax return.

IR-2021-159 July 28 2021. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online. Where is my unemployment tax refund.

Thats frustrating for taxpayers waiting on their refunds which have averaged over 3000 this year. An immediate way to see if the IRS processed your refund and for how much is by viewing your tax records online. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online.

You wont be able to track the progress of your refund through the IRS Get My Payment tracker the Wheres My Refund tool the Amended Return Status tool or another IRS portal. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in. The 10200 exemption applied to individual taxpayers who earned less than 150000 in modified adjusted gross income.

How to Check the Status of Your Refund. Will I receive a 10200 refund. Ad Learn How Long It Could Take Your 2021 State Tax Refund.

In general all unemployment compensation is taxable in the tax year it is received. Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946.

I filed taxes in february and received my refund in march but i havent received the. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946. See How to File for options including IRS Free.

Heres how to check your tax transcript online. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer. For this round the average refund is 1686 direct deposit refunds started going out Wednesday and paper checks today.

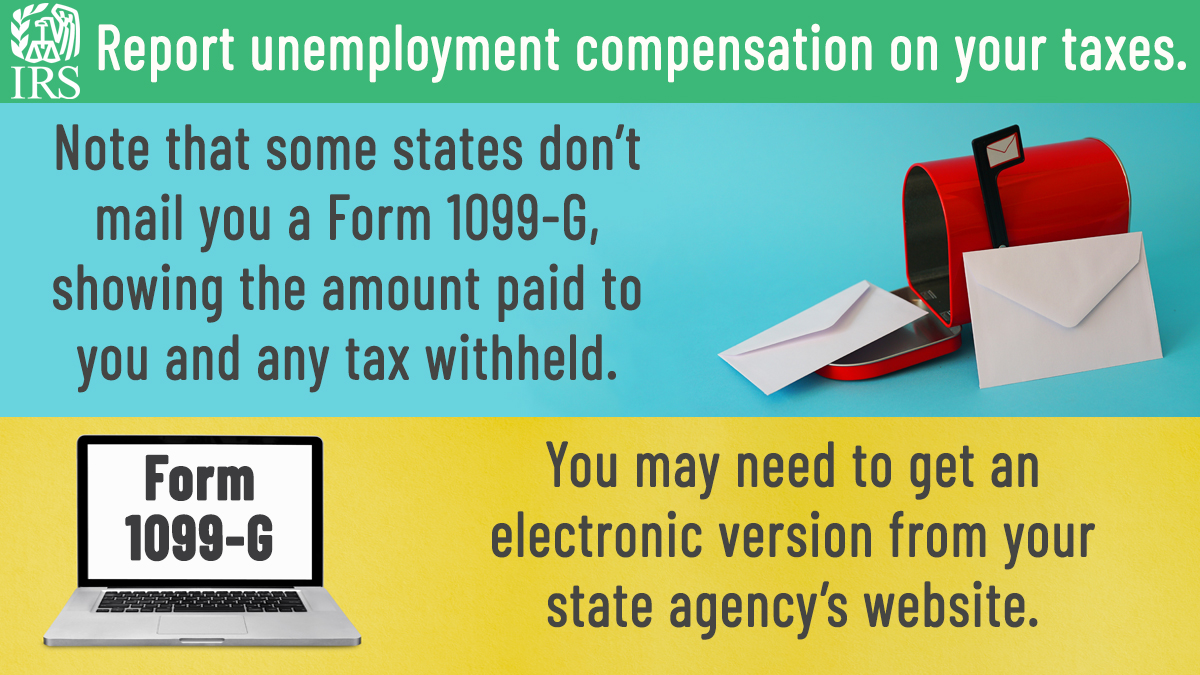

How do I check on my unemployment. The Internal Revenue Service doesnt have a separate portal for checking the unemployment compensation tax refunds. You should receive a Form 1099-G showing in box 1 the total unemployment compensation paid to you.

This is the most efficient and easiest way to track your return. I filed for unemployment last May. You can try the IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool but they may not provide information on the status of your unemployment tax refund.

If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check. How much kids would have if you invest tax credit until theyre 18. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their 2020 tax returns.

I paid taxes on my benefits as well. I received benefits for the rest of that year until obviously this May. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time.

In the latest batch of refunds announced in November however the average was 1189. You may check on the status of your refund by calling the IRS. Who Is Eligible For An Unemployment Tax Return.

Track tax refunds using the Wheres My Refund tool at IRSgov 14 Feb 2020 1026 AM Anonymous. Check For the Latest Updates and Resources Throughout The Tax Season. The Internal Revenue Service doesnt have a separate portal for checking the unemployment compensation tax refunds.

But If you are looking for tax refunds that include injured spouse allocation then you might have to wait for 14 weeks. An immediate way to see if the IRS processed your refund is by viewing your tax records online. COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable amount of unemployment compensation and tax.

These updated FAQs were released to the public in Fact Sheet 2022-21 PDF March 23 2022. Check your unemployment refund status by entering the following information to verify your identity. By Anuradha Garg.

It comes as some families may be forced to pay back their child tax credits to the IRS. You can use the IRS online tracker applications the Wheres My Refund and Amended Return Status tools. I also claimed my son.

You can try the IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool but they may not provide information on the status of your unemployment tax refund. Where is my 2021 tax refund from the IRS. But theres one bit of good news.

The refund average is 1686. Why am I not getting a refund for my unemployment because I was owed 1100 for my sons. Another way is to check your tax transcript if you have an online account with the IRS.

For the latest information on IRS refund processing during the COVID-19 pandemic see the IRS Operations Status page. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. An immediate way to see if the IRS processed your refund is by viewing your tax records online.

700 worth of taxes for benefits last year.

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Unemployment Tax Break Refund How To Check Your Irs Transcript For Clues

Irs Unemployment Refund Update How To Track And Check Its State As Usa

Unemployment Tax Refund Update What Is Irs Treas 310 Wcnc Com

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Here S How To Track Your Unemployment Tax Refund From The Irs

Fury As Major Tax Refunds Are Delayed For Millions Of Americans Because Irs Staffers Are Working From Home

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Heartbreaking Stories Emerge As Millions Await Tax Refunds Or Stimulus Payments From Irs Fingerlakes1 Com

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Irs Tax Refund Delays Persist For Months For Some Americans Abc11 Raleigh Durham

Irsnews On Twitter If You Received Unemployment Compensation During The Year You Must Include It In Gross Income On Your Irs Tax Return See Details At Https T Co Lhsbya2bvu Https T Co Vfio1irxik Twitter

Irs Updates Where S My Refund Signals Az

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

Irs Sends First Unemployment Tax Refunds But Automatic State Refunds Are In Limbo Mlive Com

Where Is My 2 200 Irs Slow To Rollout Unemployment Tax Refund The National Interest

Your Tax Return Is Still Being Processed Irs Where S My Refund 2022

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet